Discrete compounding is the process of calculating and adding interest to the principal at specific moments in time. Interest, for instance, might be compounded every week, monthly, or annually. In contrast to continuous compounding, which employs a method to assess interest as though it was continually computed and applied to the principal, discrete compounding may be thought of as the opposite of that process.

Important Notes

- Interest is added to a total balance on a regular basis via discrete compounding.

- In the same way that other types of compounding work, discrete compounding works by crediting interest on the whole amount of the debt, which includes any interest that has previously been earned or charged.

- Over time, the larger the worth of a single dollar will be when compounding durations (e.g., weeks vs. years) are as short as possible.

How Distinct Compounding Operates

Interest is accrued on interest that has previously been collected in prior periods via a process known as compound interest. A deposit account with an annual interest rate of one percent would yield interest of $1 with an original balance of $100; however, the interest earned in the second year will indeed be calculated relying on a preliminary balance of $101 (presuming no extra deposits or withdrawal of funds were made), resulting in the interest of $0.01. Compared to last year, one cent more. As one's main amount rises and interest rates climb, these numbers become increasingly significant.

In the scenario of a bank account, annual interest is a sort of discrete compounding as it's computed once a year. It's also possible to do things on a more frequent schedule, such as every month, week, or even every day. Compounding interest is a kind of interest that accrues on a daily basis, which means that the amount you end up owing may rapidly rise to enormous sums.

Keep in mind that compounding isn't available on all interest-bearing securities. You would get $100 annually on the $1,000 original cost of a ten percent (ten percent) annual fixed-rate bond, for example. An account's future value may be determined using the following formula:

FV=P (1+ r/m) mt

Compounding Frequency's Influence

The yearly percentage yield of an investment is somewhat affected by how often interest is compounded (APY). Let's say you put $100 into a savings account with a 5% yearly interest rate. If the bank's interest is compounded yearly, you'll conclude the year with $105 in your account. Instead of $105.13, you'll have $105.12 at the conclusion of the fiscal year if the bank compounded interest every day. Compound interest is compounded every day, even by the bank that has demonstrated disdain for millions of its consumers by opening false accounts in order to fraudulently increase bank earnings. That's because monthly, semi-annually, or yearly APY returns are lower than those from discrete compounding.

Nevertheless, the typical consumer of Wells Fargo is not exactly bouncing up and down with joy. Although the economy has seen a decline in interest rates, Wells Fargo's APY for basic accounts for checking & savings is considerably lower at 0.01 percent. Wells Fargo "Way2Save" accounts pay 0.1% interest. To put it another way, if you placed $10,000 in a savings account, your annual interest earnings would be a measly $1.00. A $10,001 sum would be in the savings account. That's probably not the best approach to save money, but don't worry; you can utilize that one buck and get a cup of Starbucks coffee instead.

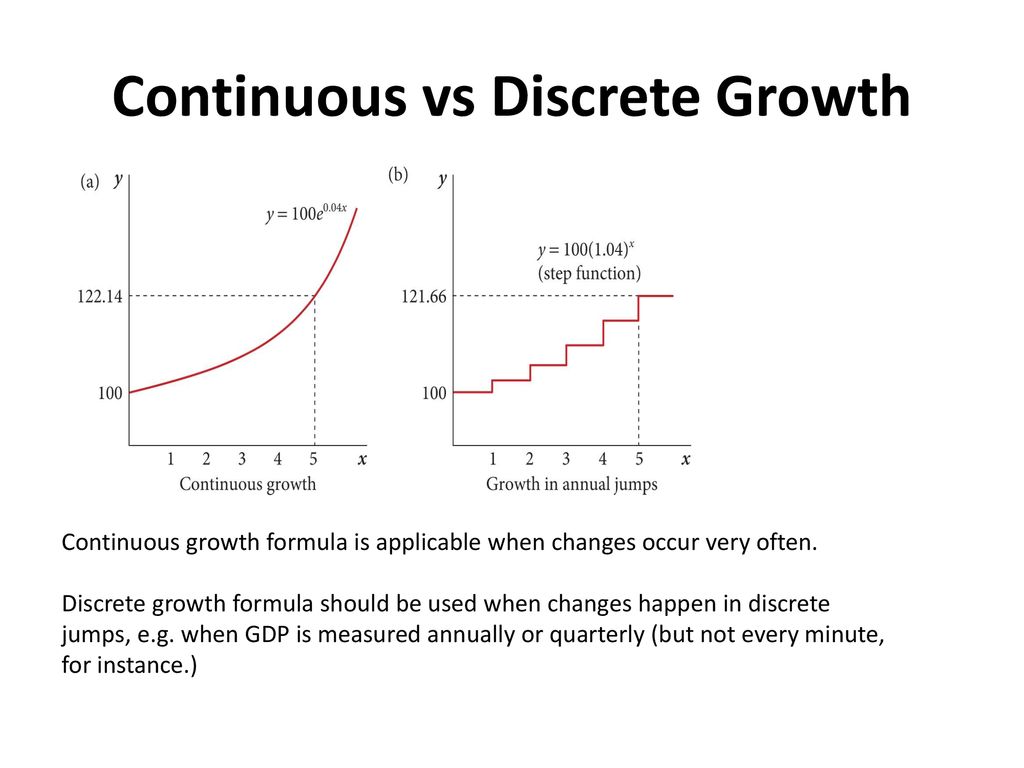

An Analysis of Discrete Versus Continuous Compounding

When individuals invest, they do so with the hope of making a profit in excess of what they put in. Interest is the name given to the additional sum. Interest is compounded variably depending on the kind of investment. One of the most prevalent ways in which interest accumulates is via the use of discrete or continuous compounding. The words "continuous compounding" & "discrete compounding" are synonymous. At regular intervals, discrete compounded interest is computed and applied to the principal. Natural logs are used to compute and add back accumulated interest at the lowest feasible periods in continuous compounding.

A variety of time periods may be used to compound interest separately. The quantity and separation between compounding phases are specifically specified in discrete compounding. Discrete interest, for instance, is interest that accrues on the first of each month. Continuous compounding can only be performed constantly. There is a mathematically zero separation between the two compounding periods (which are separated by just a few hundredths of a second). Compounding is separate, even if it happens on a minute or second-by-minute basis. Distinctive if it is non-continuous. A simple interest, for instance, is discrete.

Final Words

Continuous and discrete compounding both have their advantages and disadvantages. Both continuous and discrete compounding are utilized to add interest to a consumer's account. However, with continuous compounding, interest is added at many small durations than with discrete compounding. One option may be better than the other, depending on how often money is deposited into the account.